In our Estate Planning Basics post, we noted that avoiding intestacy is one reason to create an estate plan; but what is intestacy/intestate succession?

What is Intestacy/Intestate Succession?

If at the time of your death you do not have at least a will, you are deemed to die “intestate.” It is a statutory means for distributing your assets and property. Effectively, the state directs to whom your assets are distributed, and at what percentage; i.e. the State makes a will for you.

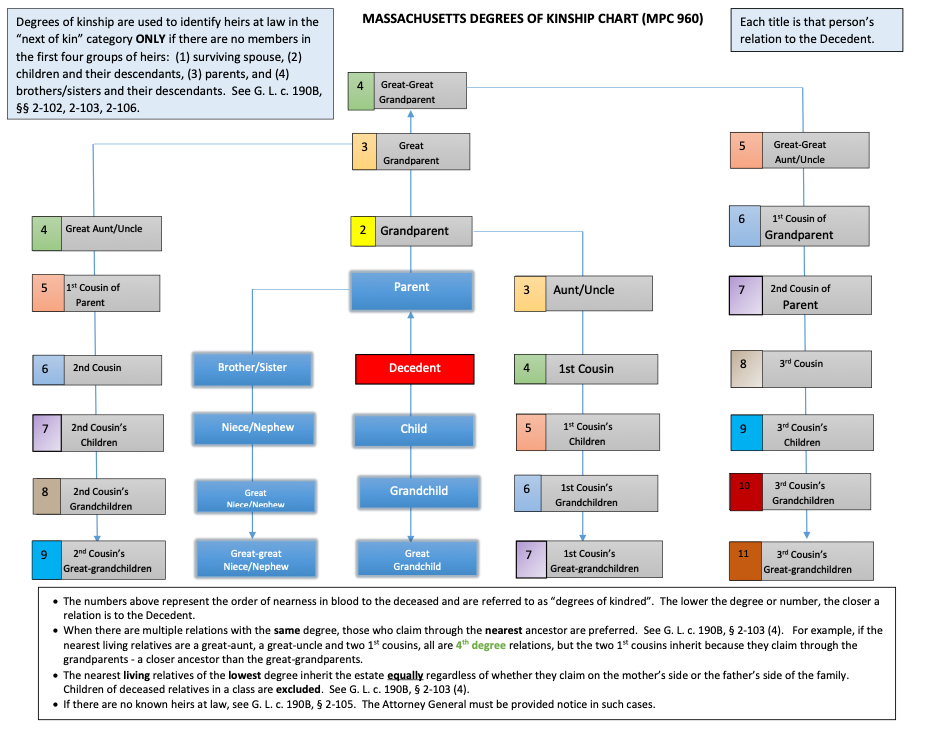

The below language taken directly from the Massachusetts General Laws, shows when and how a surviving spouse, or other heir, will take either the entire intestate estate, or may otherwise only take a certain amount. At the end of this post is the Massachusetts Degrees of Kinship Chart, which is used to identify heirs at law in the “next of kin” category, should that category be triggered.

As you can see, without proper estate planning, depending on one’s familial situation, it is entirely possible an estate may not be distributed as one may think or want, and may even be distributed to those extremely far removed from the decedent – which likely does not align with one’s intended goals or desires.

Spousal share: G.L. c190B §2-102

The intestate share of a decedent’s surviving spouse is:

(1) the entire intestate estate if:

(i) no descendant or parent of the decedent survives the decedent; or

(ii) all of the decedent’s surviving descendants are also descendants of the surviving spouse and there is no other descendant of the surviving spouse who survives the decedent;

(2) the first $200,000, plus .75 of any balance of the intestate estate, if no descendant of the decedent survives the decedent, but a parent of the decedent survives the decedent;

(3) the first $100,000 plus .5 of any balance of the intestate estate, if all of the decedent’s surviving descendants are also descendants of the surviving spouse and the surviving spouse has 1 or more surviving descendants who are not descendants of the decedent;

(4) the first $100,000 plus .5 of any balance of the intestate estate, if 1 or more of the decedent’s surviving descendants are not descendants of the surviving spouse.

Share to Heirs Other Than Surviving Spouse: G.L. c190B §2-103

Any part of the intestate estate not passing to the decedent’s surviving spouse under section 2–102, or the entire intestate estate if there is no surviving spouse, passes in the following order to the individuals designated below who survive the decedent:

(1) to the decedent’s descendants per capita at each generation;

(2) if there is no surviving descendant, to the decedent’s parents equally if both survive, or to the surviving parent;

(3) if there is no surviving descendant or parent, to the descendants of the decedent’s parents or either of them per capita at each generation;

(4) if there is no surviving descendant, parent, or descendant of a parent, then equally to the decedent’s next of kin in equal degree; but if there are 2 or more descendants of deceased ancestors in equal degree claiming through different ancestors, those claiming through the nearest ancestor shall be preferred to those claiming through an ancestor more remote. Degrees of kindred shall be computed according to the rules of civil law.

Massachusetts Degrees of Kinship Chart

For more information about probate and estate planning, schedule a free consultation with Zuccaro Law, LLC today!

No information in this blog post is to be construed as, nor is intended to be, legal or tax advice. Consult with competent legal counsel and/or tax professionals prior to taking any action. Do not rely on any information contained in this blog post as the law changes from time-to-time and this blog post may not be updated to reflect those changes.

© Zuccaro Law, LLC. All Rights Reserved.